TL;DR

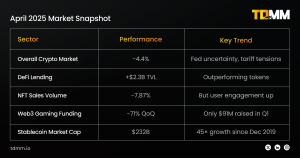

April 2025 was a month of realignment and reckoning. Regulatory clarity, institutional moves, and on-chain innovation battled market headwinds and shifting narratives. DeFi matured, NFTs wrestled with volume versus engagement, stablecoins hit new highs, and the majors-Bitcoin and Ethereum-proved their mettle. Let’s break down the facts, trends, and what’s next in our roundup.

Introduction

If the past few months were about hype cycles, April 2025 was about hard-earned progress. Against a backdrop of Fed uncertainty and global trade tensions, the crypto ecosystem doubled down on real innovation and resilience. Regulatory wins gave DeFi new momentum, while institutions and builders focused on solutions that will last. This roundup explores how the industry is moving beyond speculation, spotlighting the projects and trends shaping crypto’s next chapter.

1. DeFi

Policy win: The DeFi space transformed dramatically this April, starting with a significant regulatory victory when President Trump signed H.J.Res.25, repealing the IRS’s controversial broker rule. This legislative win removed a major cloud hanging over decentralized protocols and liquidity providers, though centralized exchanges still face reporting requirements.

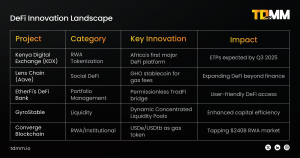

Africa steps up: Beyond regulatory relief, DeFi’s global footprint expanded significantly. Kenya Digital Exchange (KDX) emerged as Africa’s DeFi gateway through a groundbreaking partnership between DeFi Technologies and the Nairobi Stock Exchange. This platform aims to tokenize real-world assets with phased rollouts throughout 2025 and ETP listings expected by Q3. Africa-long overlooked in crypto conversations-is now firmly on the DeFi map.

Lens Chain goes live: Lens Chain launched as Aave’s ambitious Ethereum overlay blockchain for decentralized social media. Using Aave’s GHO stablecoin for gas fees and decentralized data storage, Lens Chain represents DeFi’s expansion beyond pure finance into broader Web3 social applications-a significant evolution for the sector.

Aave and Pendle evolve: Institutional engagement intensified as BlackRock, Aave, and Uniswap deepened their DeFi involvement. Aave initiated token buybacks while Pendle proposed launching fixed-yield tokens (Pendle PTs) on the platform, signaling sophisticated yield strategies gaining traction. DeFi lending protocols added an impressive $2.3 billion in TVL, outperforming many tokens despite market headwinds.

Technical edge: Technical innovation continued at pace with EigenLayer’s Slashing Upgrade enhancing security for restaking protocols, while Velar’s PerpDEX brought leveraged futures trading directly to Bitcoin via Stacks-a first for Bitcoin-native DeFi. Perhaps most significantly, Vitalik Buterin proposed replacing Ethereum’s EVM with RISC-V architecture, potentially revolutionizing scalability for the entire ecosystem.

Not all was smooth sailing, however. An AWS outage exposed DeFi’s lingering dependency on centralized infrastructure, while funding for Web3 gaming and DeFi projects plummeted to just $91 million in Q1 2025-a sobering 71% drop from Q4 2024.

2. NFTs & Gaming

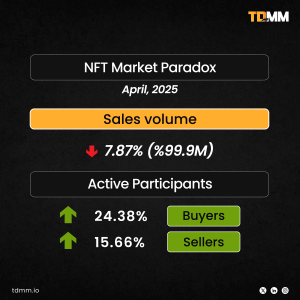

The NFT market presented a fascinating paradox in April. While sales volume dropped 7.87% to $99.9 million (according to CryptoSlam), the number of buyers surged by 24.38% to 560,845, and sellers increased by 15.66% to 327,295. This divergence suggests a maturing market where engagement remains strong even as speculative fever cools.

Gaming leads NFT relevance: Web3 gaming emerged as NFTs’ most promising frontier, though with clear winners and losers. Cambria’s Risk-to-Earn MMO gained traction by prioritizing engaging gameplay reminiscent of RuneScape, with NFTs serving ranking and trading functions. Its success underscores a crucial lesson: fun gameplay drives adoption more effectively than tokenomics alone.

Cross-game interoperability took a significant step forward when the Pixels (PIXEL) token expanded beyond its original game to integrate with The Forgotten Runiverse fantasy RPG. This marked PIXEL’s first venture outside its native ecosystem and could establish a template for truly interoperable NFT assets.

Platform pressure: The sector’s consolidation continued with X2Y2 marketplace announcing its closure by April 30, highlighting the increasingly competitive landscape where only the most innovative platforms survive.

3. Stablecoins: Explosive Growth Meets Political Reality

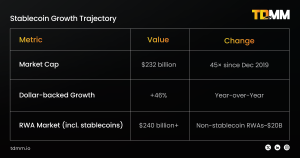

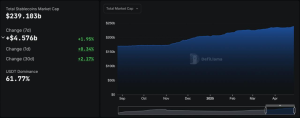

Stablecoins continued their remarkable ascent, with market capitalization reaching $232 billion by March 2025-a staggering 45-fold increase since December 2019 and $239 billion by March 2025 . Dollar-backed stablecoins grew 46% year-over-year, cementing their role as essential infrastructure for trading and DeFi collateral.

The political dimension of stablecoins intensified with the launch of World Liberty Financial’s USD1, backed by Donald Trump and his sons. This stablecoin, operating on Ethereum and Binance Smart Chain and backed by treasuries and cash equivalents, aims to penetrate DeFi applications. However, critics have raised legitimate concerns about political entanglements and financial transparency.

Legislative shifts: The U.S. House Financial Services Committee advanced the Stable Act of 2025, moving toward federal stablecoin oversight with the goal of preserving U.S. dollar dominance. In a significant clarification, the SEC declared that U.S. dollar stablecoins are not securities, providing much-needed clarity for issuers and boosting institutional confidence.

TradFi x Crypto: The stablecoin ecosystem received further validation when U.S. banks gained approval for crypto custody, stablecoin reserves, and DLT payments without special permissions. Meanwhile, PayPal partnered with Coinbase to advance adoption of its PYUSD stablecoin, further blurring the lines between traditional finance and crypto.

Global tensions surfaced when the European Central Bank warned of “contagion” risks from Trump’s pro-crypto policies, highlighting the geopolitical dimensions of stablecoin growth.

4. Regulation: Dialogue Replaces Enforcement

April marked a shift toward more constructive regulatory engagement in the U.S. The SEC hosted its first-ever crypto roundtable, discussing trading, custody, RWA tokenization, and DeFi, with four more sessions planned. This public dialogue signals a welcome pivot from “regulation by enforcement” toward proactive engagement.

Mining clarity: Specific regulatory wins included the SEC’s clarification that proof-of-work mining is not a securities transaction, benefiting miners, and the abandonment of proposed Reg ATS rule changes that could have negatively impacted DeFi protocols.

Policy watch: The GENIUS Act and OCC’s greenlight for crypto custody further eased bank entry into the space.

Looking ahead, Congressman Ro Khanna predicted that stablecoin and market structure legislation would pass in 2025, with 70-80 House Democrats supporting it. The proposed Virtual Currency Tax Fairness Act would exempt crypto transactions under $200 from capital gains taxes, potentially encouraging everyday use.

Global pulse: Globally, Canada’s Web3 Council advocated for a national blockchain strategy ahead of April 28 elections, with voters showing strong crypto support. Meanwhile, China prepared emergency plans to counter U.S. tariffs, creating uncertainty that could indirectly affect crypto markets.

Enforcement concerns haven’t disappeared entirely. A former SEC adviser warned that “regulation by enforcement” persists despite federal changes, while Coinbase, Kraken, and others urged blocking DOJ prosecution of Web3 developers involved with privacy-focused protocols like Tornado Cash.

5. AI, Infrastructure, and Market Trends

The broader Web3 ecosystem saw significant developments beyond the major categories. Web3 gaming continued its search for sustainable models, with Pixels succeeding by prioritizing gameplay over tokenomics. The sector is at “square one,” focusing on player ownership and fun.

AI integration with blockchain accelerated, with platforms enabling monetization of AI services. OpenAI’s GPT-4.1 release coincided with security concerns when a malicious npm package targeted crypto wallets, highlighting the complex intersection of AI, security, and Web3.

Infrastructure debates intensified when Solana’s controversial ad comparing pronouns to DeFi sparked community backlash, demonstrating the crypto community’s sensitivity to non-technical narratives. Meanwhile, Bybit launched its 2025 strategy emphasizing Web3 integration with on-chain asset management, trading tools, and a points-based reward system.

On the corporate front, Circle moved forward with IPO plans, hiring JPMorgan and Citi as underwriters-a strong signal of crypto’s continued march toward mainstream financial acceptance.

The Bottom Line: April’s Hard Truths

April 2025 wasn’t explosive—but it was definitive. We moved from speculation to structure. The market is maturing—slowly, but undeniably.

For investors, builders, and users alike, the message is clear: execution matters more than excitement. As we move into May with Ethereum’s Pectra upgrade on the horizon and major conferences like TOKEN2049 Dubai and Consensus 2025 approaching, the projects that deliver real value will separate themselves from those merely riding the hype cycle.

The crypto space isn’t waiting for promises anymore — it’s rewarding delivery.

We work with crypto-native teams focused on long-term value,, helping them design liquidity strategies that are practical, sustainable, and built for what’s next.

If you’re building for the long term, let’s connect — and make sure your project stands where the future is headed.